| Conducting Body | State Bank of India (SBI) | Institute of Banking Personnel Selection (IBPS) |

| Participating Banks | State Bank of India only | 11 Public Sector Banks (Bank of Baroda, Canara Bank, Bank of Maharashtra, Bank of India, Central Bank of India, Indian Overseas Bank, Punjab & Sind Bank, Punjab National Bank, Indian Bank, UCO Bank, Union Bank of India) |

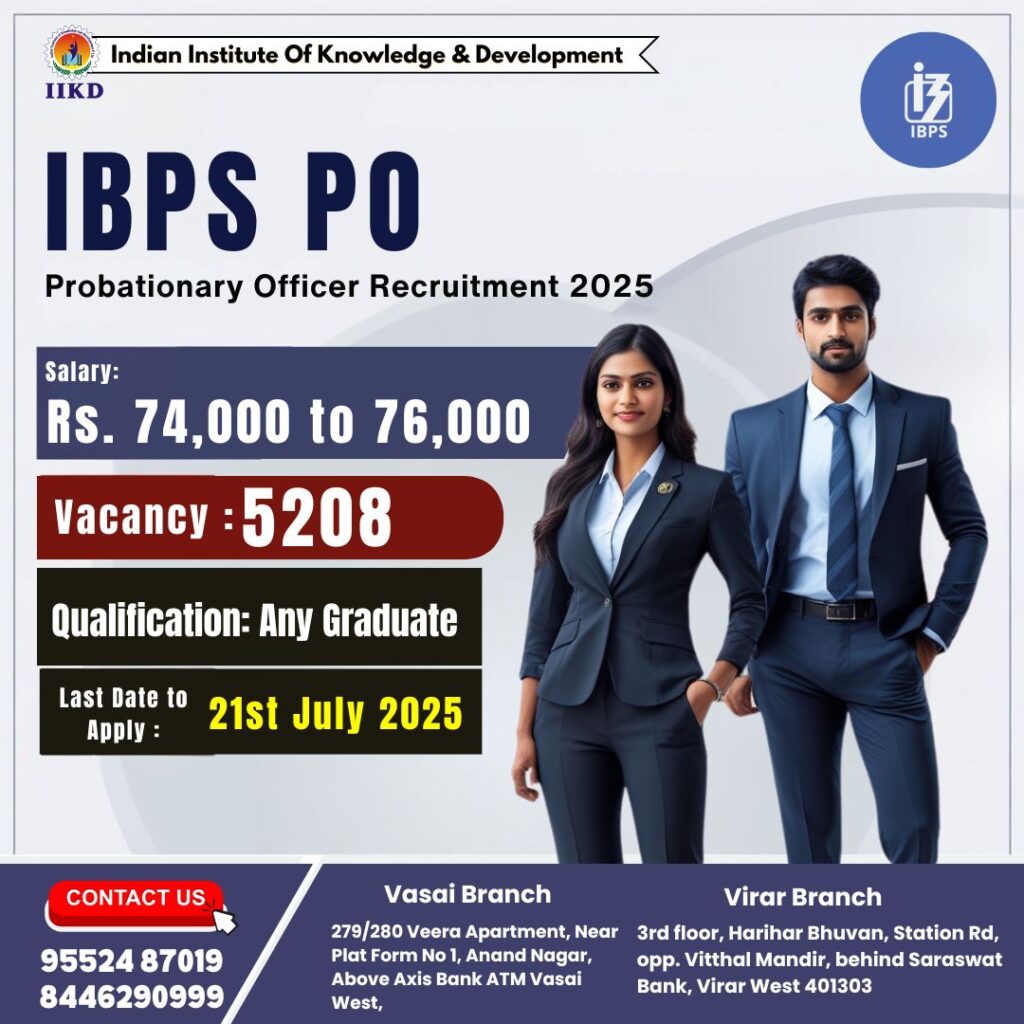

| Annual Vacancies | Approximately 2,000 – 2,500 | Approximately 3,000 – 5,208 |

| Age Limit | 21 to 30 years (as of 1st April) | 20 to 30 years (as of 1st July) |

| Age Relaxation (SC/ST) | 5 years | 5 years |

| Age Relaxation (OBC) | 3 years | 3 years |

| Age Relaxation (PwD – General) | 10 years | 10 years |

| Age Relaxation (PwD – SC/ST) | 15 years | 15 years |

| Educational Qualification | Graduation in any discipline from a recognized university | Graduation in any discipline from a recognized university |

| Number of Attempts | General/EWS: 4 attempts; OBC/PwD: 7 attempts; SC/ST: Unlimited | No limit (subject to age eligibility) |

| Exam Pattern – Prelims | 3 sections: English Language (40Q), Quantitative Aptitude (30Q), Reasoning Ability (30Q) – Total 100 marks in 60 minutes | 3 sections: English Language (30Q), Quantitative Aptitude (35Q), Reasoning Ability (35Q) – Total 100 marks in 60 minutes |

| Exam Pattern – Mains (Objective) | 4 sections: Reasoning & Computer Aptitude (40Q, 60 marks), Data Analysis & Interpretation (30Q, 60 marks), General/Economy/Banking Awareness (60Q, 60 marks), English Language (40Q, 20 marks) – Total 170Q, 200 marks | 4 sections: Reasoning & Computer Aptitude (40Q, 60 marks), General/Economy/Banking Awareness (35Q, 50 marks), English Language (35Q, 40 marks), Data Analysis & Interpretation (35Q, 50 marks) – Total 145Q, 200 marks |

| Descriptive Paper | Essay, Report & Either Summary or Precis (50 marks in 30 minutes) | Essay & Letter Writing (25 marks in 30 minutes) |

| Selection Process | Prelims → Mains → Psychometric Test → Group Exercise & Personal Interview | Prelims → Mains → Personal Interview |

| Final Merit Weightage | Mains (75%) + Group Exercise & Interview (25%) | Mains (80%) + Interview (20%) |

| Interview Marks | Group Exercise: 20 marks, Personal Interview: 30 marks (Total 50 marks) | Personal Interview: 100 marks |

| Interview Qualifying Marks | As per notification | General: 40%; SC/ST/OBC/PwD: 25% |

| Basic Pay (Starting) | Rs. 48,480 (with 4 advance increments = Rs. 56,480) | Rs. 48,480 |

| Pay Scale | Rs. 48,480-2000/7-62,480-2340/2-67,160-2680/7-85,920 | Rs. 48,480-2000/7-62,480-2340/2-67,160-2680/7-85,920 |

| Gross Monthly Salary | Rs. 90,000 – 94,581 approximately | Rs. 78,058 – 90,733 approximately |

| In-Hand Salary (Monthly) | Rs. 80,000 – 85,000 approximately | Rs. 71,863 – 76,431 approximately |

| Annual CTC | Rs. 12 – 20.43 lakhs (Mumbai Centre) | Rs. 7.2 – 7.8 lakhs |

| Allowances & Perks | DA, HRA/Leased Accommodation, CCA, Medical Benefits (100% for self, 75% for family), Petrol Allowance, Furniture Allowance, Newspaper Allowance, LFC, PF, Pension, Gratuity | DA, HRA, Special Allowance, Medical Benefits (up to Rs. 8,000/year), LTC, PF, Pension |

| Career Growth & Promotions | Faster promotions due to larger bank size; opportunities for foreign postings in 190+ offices across 36 countries | Steady growth; regular promotions across participating banks; limited foreign posting opportunities |

| Promotion Path | PO (Assistant Manager) → Deputy Manager → Manager → Chief Manager → AGM → DGM → CGM → General Manager | Similar hierarchy across participating banks but relatively slower |

| Transfer Policy | Frequent transfers; pan-India posting; typically 2-3 years at one location; mandatory inter-state transfers | Less frequent transfers; usually within region or state; depends on individual bank policy |

| Work Pressure | High – due to large customer base, business targets, and extensive operations | Moderate – workload distributed across multiple banks |

| Work Culture | Fast-paced, dynamic; higher expectations and targets | Relatively balanced; varies by participating bank |

| Exam Difficulty Level | Higher difficulty – tougher General Awareness section, competitive interview process | Moderate difficulty compared to SBI PO |

| Official Website | sbi.co.in | ibps.in |

| Key Advantages | Higher salary package, faster career progression, prestigious brand value, foreign posting opportunities, better perks and allowances | More bank options (11 banks), no attempt limit for most categories, relatively easier exam, more vacancies, better work-life balance |

| Key Challenges | Limited attempts (4 for General category), tougher exam, high work pressure, frequent transfers, competitive environment | Lower salary compared to SBI, slower promotions, limited foreign posting opportunities, bank allocation based on merit and preference |